Trusted by more than

18 million Americans

seeking affordable health insurance

An easier way to compare and buy

health insurance

Health insurance enrollment made quick & easy

Learn

Find out everything you ever (or never) wanted to know about your health insurance options.

Compare

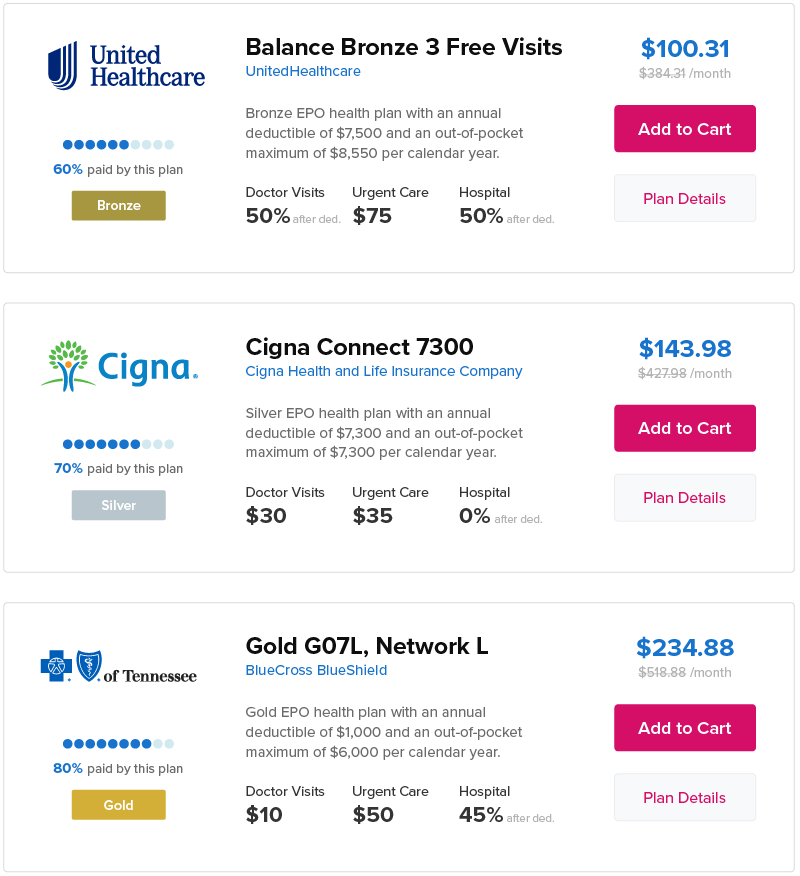

Find what matters to you by comparing different plans, benefits & rates from the nation’s top carriers.

Apply

Get a personalized quote and choose the health plan with the right benefits at the right price for you.

Get started by comparing plan pricing with a personalized health insurance quote.

Find the right health insurance for you

Pre-existing conditions

Marketplace plans can’t deny you coverage or charge you higher premiums because of your health history. That means pre-existing conditions are protected under the law.

Prescription drug

Prescription drugs are an essential health benefit under the law, which means marketplace plans have to cover them.

Essential health benefits

Current healthcare law requires marketplace plans to cover 10 essential health benefits, things like preventive care, emergency services, mental health care & more. It’s full, robust health insurance.

We can get you a quote from top health insurance carriers

Get access to benefit info and rates from all of the plans offered on the marketplace, plus others you won’t find on the federal or state exchanges. When you’ve found a plan that fits your needs and budget, you can enroll entirely on your own with our quick & easy enrollment system.

Need some help? No problem. Just give us a call to talk to a licensed insurance agent about your options, or schedule a phone appointment at a time that works for you. We’re happy to help you however (and whenever) we can.

Healthcare Marketplace

By More Than

18 Million Americans

We’ve helped over 18 million people shop for health insurance. We’re dedicated to helping Americans find affordable coverage that works for them because we believe that people matter.